Saiu o tão esperado anúncio!

A empresa fará o IPO na Nasdaq, e espera levantar cerca de $100m. Doletas! Abaixo você encontra o form S1, registrado na SEC. Surreal o crescimento na casa de 90% no primeiro semestre se comparado ao período anterior!

Congrats, Stoners!!

Highlights:

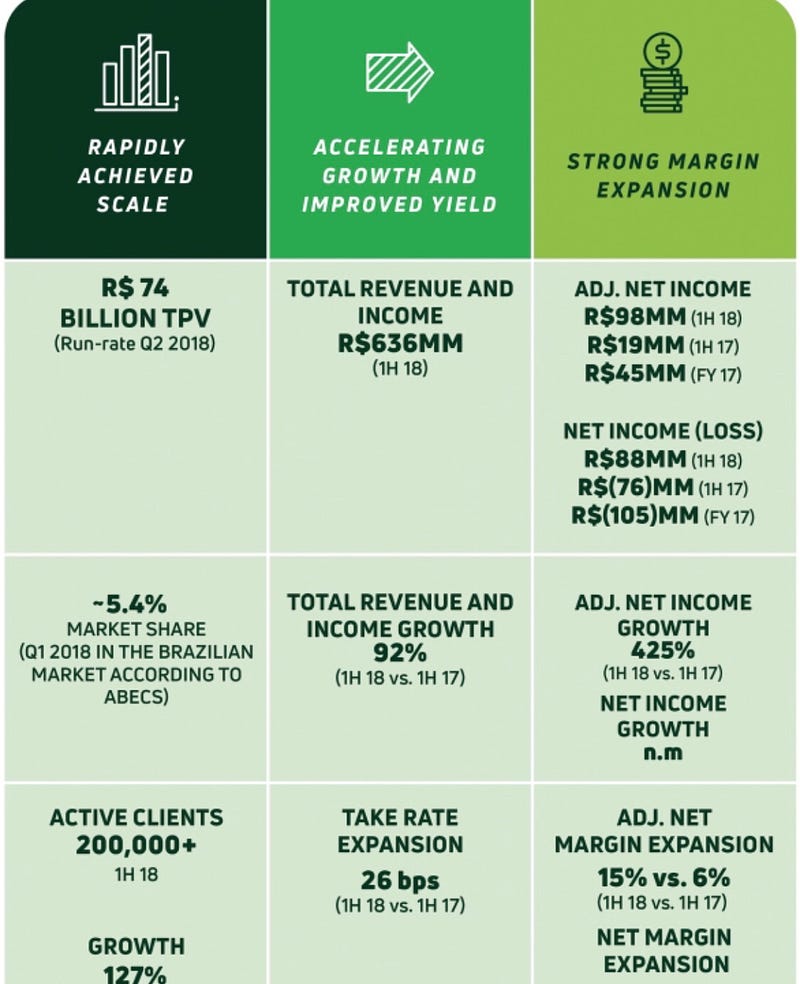

- We generated R$635.7 million of total revenue and income in the six months ended June 30, 2018, compared to R$331.8 million in the six months ended June 30, 2017, representing period over period growth of 91.6%. In 2017, we generated R$766.6 million of total revenue and income, compared to R$439.9 million of total revenue and income in 2016, representing annual growth of 74.3%.

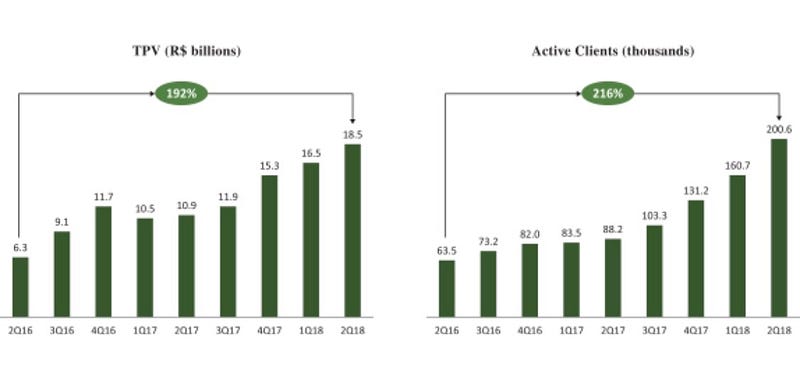

- We served approximately 200,600 active clients as of June 30, 2018, compared to approximately 88,200 as of June 30, 2017, representing period over period growth of 127.5%. As of December 31, 2017, we served approximately 131,200 active clients, compared to approximately 82,000 as of December 31, 2016, representing 60.1% annual growth.

- We generated net income of R$87.7 million and adjusted net income of R$97.6 million in the six months ended June 30, 2018, compared to a loss of R$75.9 million and adjusted net income of R$18.6 million in the six months ended June 30, 2017. In 2017, we generated a loss of R$105.0 million and adjusted net income of R$45.2 million, compared to a loss of R$122.2 million and adjusted net loss of R$51.9 million in 2016. See “Summary Financial and Other Information” for a reconciliation of adjusted net income (loss) to our profit (loss) for the period.

- We processed TPV of R$35.1 billion in the first half of 2018, compared to R$21.4 billion in the first half of 2017, representing period over period growth of 63.9%. In 2017, we processed TPV of R$48.5 billion, compared to R$28.1 billion in 2016, representing 72.7% annual growth.

Saca a retenção:

E o take rate…